Content

It Betsoft production integrates movie noir aesthetics having lively 3d animations to deliver a keen immersive betting sense one shines on the packed on line position field. The fresh game’s mystical nighttime function produces the perfect background to own uncovering clues and you will going after off rewards round the the 5 reels and 30 paylines. The new separate customer and you will self-help guide to online casinos, online casino games and you will gambling establishment incentives. Matt is actually a great co-inventor of one’s Casino Wizard and a lengthy-time online casino fan, checking out his first internet casino inside the 2003.

When you’re an indicator-upwards offer are an incentivizing need to open a new lender account, before taking benefit of a plus you should figure out how far currency available in order to move into an alternative membership. Provide quantity are very different and you will bigger incentives may need a larger cash deposit. These types of bonuses can be worth more $100 and usually wanted certain conditions to meet the requirements, for example and then make at least put or joining head deposit. To draw clients, of numerous financial institutions often offer a sign-right up bonus when you open an alternative membership. To own examining membership particularly, these types of incentives is going to be at least $one hundred.

When the a borrower asks the college to do so, the institution is to head these to the right servicer to possess guidance about how precisely they could go back the bucks. The reason being Lead Mortgage finance returned 120 weeks or even more after the disbursement are processed because the a cost without adjustment of loan charges otherwise desire. Whenever acting abreast of a termination consult, their university need return the money (if the acquired) and/otherwise cancel the borrowed funds or give because the compatible.

If you utilize real car expenses to figure their deduction to have an automobile you possess and rehearse on your own company, you might claim an excellent depreciation deduction. It means you could potentially subtract a specific amount annually as the a data recovery of one’s rates or other basis on your car. You can choose not to ever allege the newest special depreciation allowance to own your vehicle, truck, or van that’s qualified possessions. If you make so it election, it pertains to the 5-seasons assets placed in service in the year. You’re in a position to allege the fresh unique decline allotment to own your car or truck, truck, otherwise van when it is licensed possessions and try placed in service in the 2024.

When you are entitled to a reimbursement from the employer however, you wear’t allege they, you can’t allege an excellent deduction to the expenditures to which you to definitely unclaimed compensation enforce. For individuals who gotten a type W-2 and also the “Statutory personnel” package inside the field 13 try searched, report your earnings and you may casino Keks expenses linked to you to definitely income to your Agenda C (Form 1040). More resources for simple tips to declaration your expenditures to your Function 2106, find Completing Function 2106, later. Desk 5-dos and you will Dining table 5-step 3 are samples of worksheets that can be used for tracking company expenditures. Staff which provide the information and you will documents to their companies and you will is refunded due to their expenses essentially wear’t must keep duplicates for the advice. Yet not, you might have to show the expenditures or no of your own following the criteria pertain.

Tips Confirm Expenditures: casino Keks

You’ve got a taxation household even if you don’t have a consistent or head office. If you have several normal place of business, your own taxation house is most of your office. A great naval administrator assigned to long lasting obligations aboard a boat one provides regular eating and you will life style organization have a taxation home (said second) on board the fresh vessel to have take a trip bills aim.

How can i discover the most recent no-deposit bonuses?

If your organization explore is actually 50% or smaller, you must use the straight-line method of depreciate your vehicle. Generally, you ought to make use of car more 50% to possess certified business have fun with (discussed 2nd) inside the year to utilize MACRS. You need to satisfy which far more-than-50%-fool around with try yearly of the recovery period (6 decades below MACRS) for the automobile. Essentially, your contour depreciation for the vehicles using the Changed Expidited Costs Data recovery (MACRS) discussed afterwards within chapter. For many who change the access to a car from individual to organization, the basis for decline ‘s the smaller of the fair industry really worth or their adjusted basis on the car to your day out of sales. More regulations about the basis are talked about after inside part less than Unadjusted foundation.

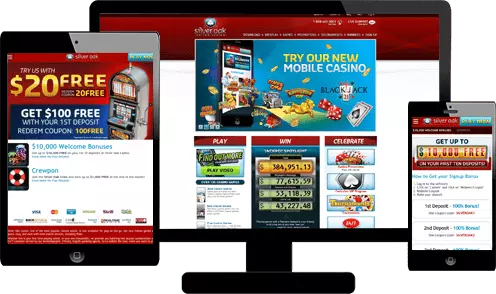

Minimum deposit gambling enterprises tend to need a-one-go out playthrough ahead of withdrawals, and at least put requirements. No-deposit bonuses along with normally have playthrough conditions ahead of finance is be taken, ensuring players engage the working platform first. Debit and you may credit cards are recognized for the comfort and you may brief control moments, causing them to one of the most are not approved payment steps during the online casinos.

Find no-deposit incentives found in their nation

The decline deductions was at the mercy of the fresh depreciation constraints, so you will get unrecovered base after the brand new recuperation months because the revealed from the pursuing the table. For individuals who itemize your own deductions to your Schedule A good (Setting 1040), you could potentially subtract online 5c condition and you can local personal property taxes for the cars. You can take that it deduction even if you utilize the standard mileage rates or you don’t utilize the auto to have team. A salesman possess three autos and two vehicles which they alternative using to own askin their clients. The brand new sales rep can use the standard distance price to the business usage of one’s about three autos and also the a few vehicles while they don’t make use of them meanwhile.

Interest rate Futures Applications

Some casinos can offer other lowest deposit limits of these payment choices. If you are going to allege a deposit suits added bonus, you may need to deposit more than the minimum greeting sum. This tactic makes you save some money when you are targeting significant victories. Listed below are some these types of higher RTP harbors if you would like spin the new reels away from extremely effective video game.

- The take a trip of Denver for the edging and you can on the border back to Denver try take a trip in the us, and also the regulations inside point apply.

- Costs you pay to help you playground the car at the host to business try nondeductible driving costs.

- StashAway offers a good bucks administration provider named Simple Guaranteed you to earns you attention on the currency.

- The newest national average to possess attention-impact examining membership sits at the an abysmal 0.07% APY at the time of April 21, 2025, with regards to the FDIC.

- However, banks that provide early head put post the amount of money so you can the fresh person’s membership whenever the financial gets the direct put data.

Comprehend Bankrate’s specialist reviews before deciding where to deposit your bank account. Before you could lose your bank account for the a merchant account at your regional lender, there are a few steps you should get. HYSAs are the most effective car to own principal-shelter, self-reliance, and you can convenience. However, it’s at the mercy of the brand new Federal Put aside and its particular rate of interest choices.

The college also needs to explain the way it goes from the cancelling the brand new authorization and this a cancellation is not retroactive. The school have to modify the newest college student otherwise father or mother written down from the results of every cancellation request. If your fund is a primary Mortgage, the new notice need indicate and this money are subsidized financing, unsubsidized fund, and/otherwise And fund. A college should provide the best information which has out of the level of FSA program finance students should expect to discover.

Your info reveal that the company utilization of the truck is 90% in the 2024. Understanding down the first column for the go out listed in services and you will around the for the two hundred% DB line, you to find your commission, 32%. You multiply the newest unadjusted basis of one’s vehicle, $8,280 ($9,200 rates × 90% (0.90) business have fun with), by 32% (0.32) to figure your own 2024 depreciation deduction out of $2,650. If you exchanged you to auto (the new “dated vehicle”) for the next vehicle (the fresh “the newest automobile”) in the 2024, you ought to get rid of the order as the a mood of your own old automobile and also the purchase of the brand new vehicle. You must remove the existing automobile as the thrown away in the period of the exchange-inside the. The newest depreciable foundation of your the brand new vehicle ‘s the modified base of one’s old auto (realized because if 100% of the auto’s have fun with ended up being to own team objectives) along with any additional amount your paid for the newest vehicle.

Before applying the fresh restrict, you profile your restriction point 179 deduction becoming $9,000. This is basically the cost of your own being qualified possessions (around the most $step one,220,100000 count) multiplied by the company have fun with ($15,one hundred thousand × 60% (0.60)). You purchased a great made use of truck inside March 2023 to utilize exclusively on the land business. You didn’t allege people area 179 deduction, the fresh truck didn’t qualify for the brand new unique depreciation allocation, and you decided to utilize the two hundred% DB method of have the premier depreciation deduction during the early ages. Alternatively, utilize the chart from the book or the setting tips to have those people upcoming years..